CBDC: What It Is and Why It Matters

When working with CBDC, a Central Bank Digital Currency that lives on a distributed ledger and is backed by a sovereign. Also known as digital fiat, it aims to combine the speed of electronic money with the trust of a national currency. Stablecoin, a privately issued crypto‑asset pegged to a fiat value often gets confused with CBDCs, but stablecoins lack direct central‑bank backing and usually operate under different regulatory regimes. The underlying blockchain, a tamper‑proof ledger that records every transaction in a network of nodes provides the transparency and auditability that traditional banking systems struggle to match. However, a CBDC can't succeed without a solid financial regulation, a framework of laws and supervisory policies that govern how money is issued and used. In short, CBDC encompasses digital wallets, requires robust regulatory oversight, and is influenced by the design choices of stablecoins and blockchain tech.

How CBDCs Fit Into the Bigger Crypto Landscape

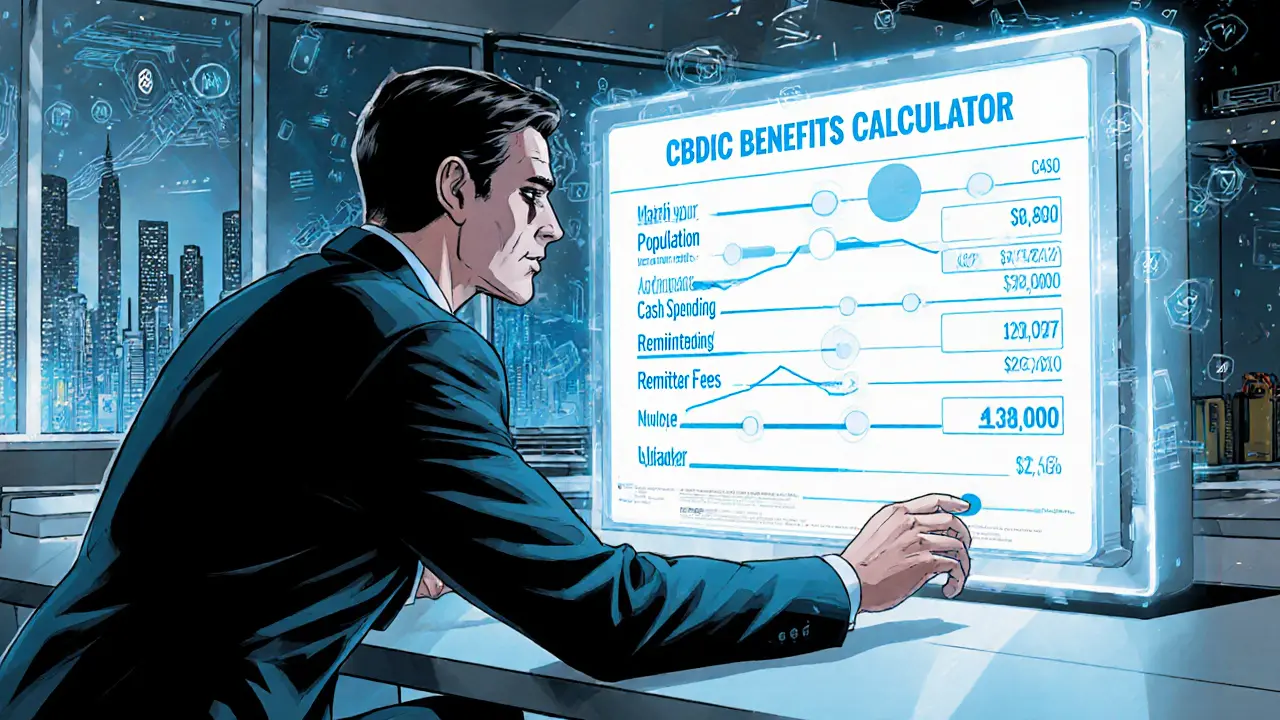

Think of a CBDC as the government’s answer to the rapid rise of private crypto assets. It leverages blockchain’s ability to settle payments instantly while keeping the central bank in control of monetary policy. This creates a semantic triple: CBDC requires financial regulation, blockchain provides the infrastructure, and stablecoins influence adoption patterns. For everyday users, a CBDC could mean cheaper cross‑border transfers, because the traditional correspondent‑bank chain gets replaced by a near‑real‑time settlement layer. At the same time, regulators see new challenges – anti‑money‑laundering checks, consumer protection, and the need to prevent destabilizing capital flight. Countries that already run pilot projects, like China’s digital yuan, are testing how digital wallets integrate with existing payment apps, showing that the user experience can be seamless if the back‑end is well designed. The interplay between CBDCs and private stablecoins also sparks competition: stablecoins push central banks to offer comparable convenience, while CBDCs force stablecoin issuers to tighten compliance to stay viable.

Below you’ll find a hand‑picked collection of articles that dive deeper into each piece of this puzzle. From step‑by‑step guides on claimable airdrops that might affect your digital wallet balance, to detailed reviews of crypto exchanges that could list emerging CBDC pilots, to analysis of global regulatory trends shaping the future of digital fiat – the posts cover the practical, the technical, and the policy‑driven sides of the story. Whether you’re just hearing the term CBDC for the first time or you’re already tracking the latest pilot results, the resources here will give you a clearer picture of what’s happening now and where the market might head next. Explore the list and take away actionable insights that you can apply to your own crypto journey.