ERC-20 Meme Coin Overview

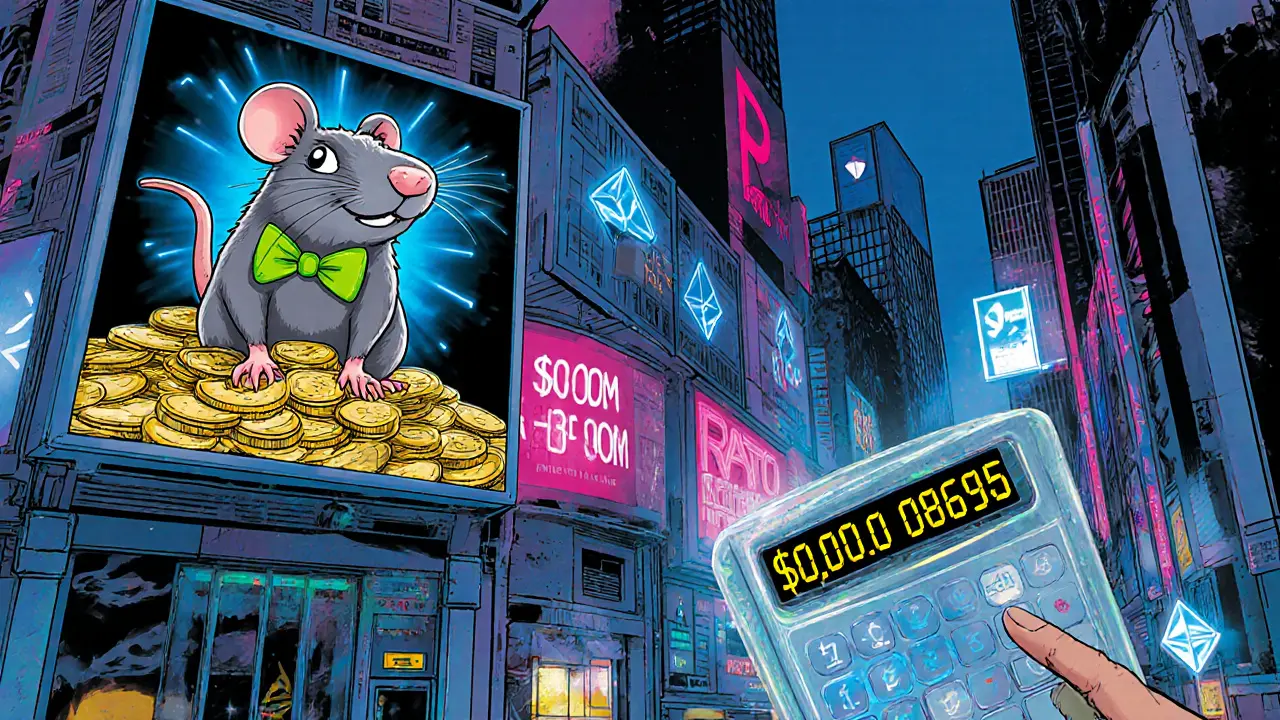

When talking about ERC-20 meme coin, a playful token built on the Ethereum ERC‑20 standard that relies on internet jokes, viral memes, and community hype. Also known as ERC20 meme token, it blends cryptocurrency tech with pop‑culture fun. A meme token, any digital asset that gains value mainly from social buzz rather than core utility often launches with a quirky logo, a catchy name, and a simple smart contract. The smart contract, another smart contract, self‑executing code on Ethereum that defines token supply, transfers, and fees, automates everything from minting to trading. Once live, these tokens usually list on a decentralized exchange, a peer‑to‑peer platform where users swap tokens without a central authority, giving the community instant access to trade and liquidity. ERC-20 meme coins therefore sit at the crossroads of tech, culture, and community.

Creating an ERC-20 meme coin starts with writing a smart contract that follows the ERC‑20 interface—balance tracking, transfer functions, and approval mechanisms. Developers often add a few gimmicks: a tiny transaction tax that funds a meme‑themed treasury, a burn feature to create scarcity, or an automatic redistribution to holders. Tokenomics, the set of economic rules behind a token, becomes the story you sell. A common pattern is a fixed supply paired with a “fair launch” where everyone can buy at the same price, avoiding pre‑sales that might scare the community. Once the contract is audited, the coin gets a contract address and can be added to a DEX like Uniswap or PancakeSwap. Listing on a DEX unlocks liquidity pools, where users deposit the meme coin and ETH (or another base token) to enable swaps. The larger the pool, the lower the slippage for traders, which fuels more buying and viral spread. In practice, many meme projects also launch a liquidity lock on a service like TeamFinance to prove they won’t pull the rug later.

Community incentives are the lifeblood of any meme token. Airdrops—free token distributions to early supporters or random wallets—are the go‑to method for rapid exposure. An airdrop can target holders of a specific token, participants in a Discord community, or anyone who completes a short task like following a Twitter account. The airdrop’s size, eligibility criteria, and claim process shape how quickly the meme spreads. Some projects pair airdrops with “viral challenges,” encouraging users to create memes, share them, and earn extra tokens. This feedback loop turns social media buzz into real market demand. However, meme coins also carry high risk: price can swing wildly on a single tweet, and many projects disappear after the hype fades. Assessing risk means looking at contract transparency, audit reports, and whether the team has a clear roadmap beyond memes. A solid meme token will balance humor with a credible plan for future development, such as NFTs, gaming integrations, or cross‑chain bridges.

What You’ll Find Next

The articles below dig deeper into each piece of the puzzle. From step‑by‑step airdrop guides and tokenomics breakdowns to exchange reviews and real‑world case studies, you’ll get practical tips to evaluate, create, or trade ERC-20 meme coins. Whether you’re new to the scene or looking to sharpen your strategy, the collection gives you the data and context you need to move forward with confidence.