- Home

- Cryptocurrency

- USD CoinVertible (USDCV) Explained: The New Institutional Stablecoin

USD CoinVertible (USDCV) Explained: The New Institutional Stablecoin

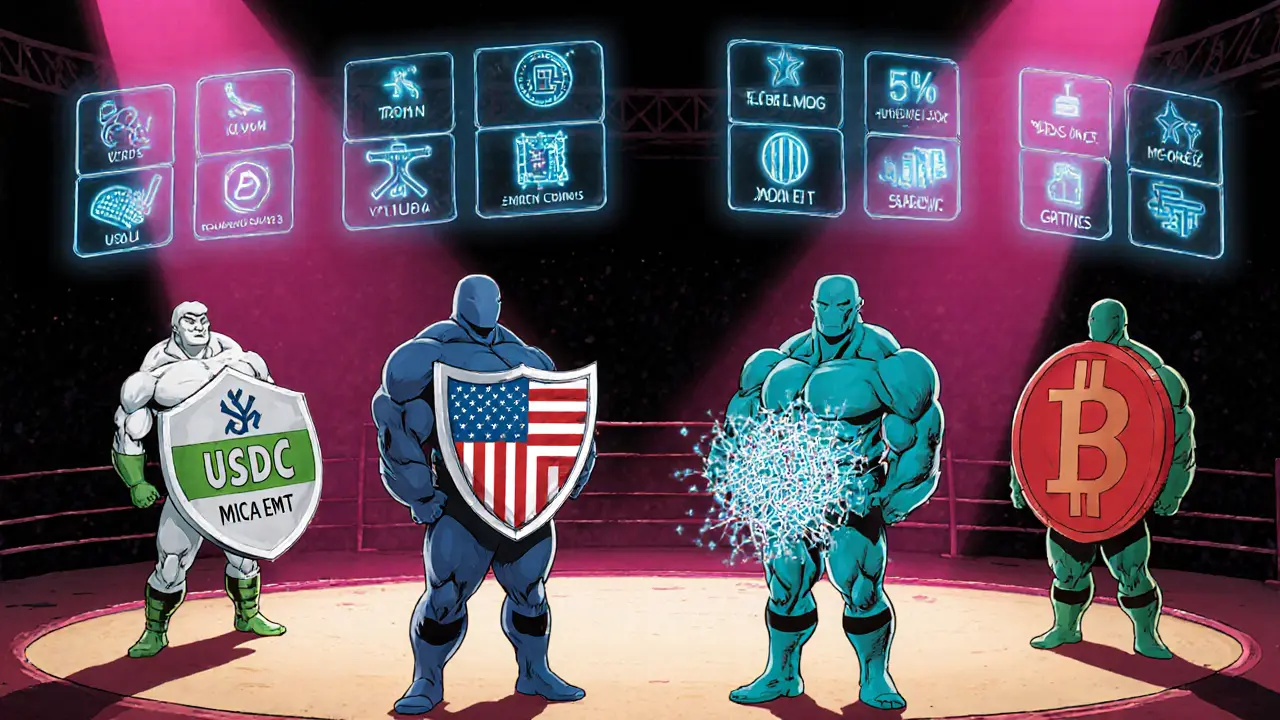

USDCV vs. Major Stablecoins Comparison

Comparison Table

| Metric | USD CoinVertible (USDCV) | USDC | USDT | BUSD |

|---|---|---|---|---|

| Launch Date | June 2025 | 2018 | 2014 | 2017 |

| Backing | Bank-held USD reserves (BNY) | US dollar reserves | US dollar reserves (mixed) | USD reserves (Paxos) |

| Regulatory Status | MiCA-compliant EMT | US regulator-approved | Limited US oversight | US regulator-approved |

| Avg. 24h Volume (M$) | 0.029 | 28 | 42 | 5 |

| Supported Chains | Ethereum, Solana | Ethereum, others | Ethereum, Tron, others | Ethereum, BSC, others |

Key Insights

Click "Update Comparison" to see detailed insights about selected stablecoin and metric.

USD CoinVertible (USDCV) is a United States dollar‑pegged stablecoin launched by the blockchain division of a French banking giant. It aims to give institutional players a digital dollar that behaves like cash while staying on public blockchains.

USD CoinVertible hit the market on June 10, 2025 and immediately began trading on both Ethereum and Solana. The price hovers around the $1.00 mark, with tiny fluctuations that are normal for a well‑backed stablecoin.

What makes USDCV different?

Unlike many community‑run tokens, USDCV is backed by real‑world assets held by a traditional custodian. Bank of New York Mellon (BNY) acts as the custodian for the reserve assets that keep the stablecoin pegged to the dollar. Every day, the reserves are audited and published, giving participants a clear view of the backing.

How does the technology work?

USDCV lives on two public chains:

- Ethereum provides a mature ecosystem of DeFi protocols and institutional‑grade tooling.

- Solana offers sub‑second finality and very low transaction fees, ideal for high‑frequency trading.

The contract address on Ethereum is 0x5422374B27757da72d5265cC745ea906E0446634. Both chains follow the ERC‑20 and SPL token standards, meaning wallets, exchanges, and smart contracts that already support those standards can handle USDCV without custom development.

Who is behind the coin?

The stablecoin is a product of Société Générale‑Forge (SG‑FORGE) the cryptocurrency and blockchain arm of the French multinational financial services company Société Générale. SG‑FORGE is authorized as an Electronic Money Institution (EMI) by the French Prudential Supervision and Resolution Authority (ACPR), giving it a regulatory footing that many crypto projects lack.

Both USDCV and its euro counterpart, EUR CoinVertible (EURCV) was launched in April 2023 as the first stablecoin from SG‑FORGE under the same model, are classified as Electronic‑Money Tokens (EMT) under the European MiCA (Markets in Crypto‑assets) regulation. This classification means the tokens have to meet strict capital, governance, and transparency requirements.

Key use cases

USDCV is built for four core scenarios:

- Crypto trading - provides a stable base pair that removes the volatility of traditional crypto assets.

- Cross‑border payments - enables near‑instant, low‑cost settlements between banks and corporate treasuries.

- On‑chain settlement - can be used to pay for services, fees, and contracts directly on Ethereum or Solana.

- Forex collateral - institutions can lock USDCV as collateral for dollar‑denominated exposures without moving cash through the traditional banking rails.

A notable milestone came in August 2025 when USDCV was one of ten stablecoins used to settle the $1.15billion NYSE IPO of Bullish, marking the first public listing to rely on crypto‑based settlement.

Market performance and adoption

As of October 2025, the circulating supply stands at about 32.25million tokens, with a market cap hovering just over $32million. Daily trading volume is modest - roughly $27‑$29million across the few exchanges that list the coin - reflecting its early‑stage, institution‑focused rollout.

Price data from two trackers shows a tiny spread:

- LiveCoinWatch: $1.0007 (+0.21% 24‑h)

- CoinGecko: $1.01 (+0.31% 24‑h)

These numbers illustrate the tight peg typical of well‑backed stablecoins.

| Metric | USD CoinVertible (USDCV) | USDC | USDT | BUSD |

|---|---|---|---|---|

| Launch date | June2025 | 2018 | 2014 | 2017 |

| Backing | Bank‑held USD reserves (BNY) | US dollar reserves | US dollar reserves (mixed) | USD reserves (Paxos) |

| Regulatory status | MiCA‑compliant EMT | US regulator‑approved | Limited US oversight | US regulator‑approved |

| Avg. 24‑h volume (M$) | 0.029 | 28 | 42 | 5 |

| Supported chains | Ethereum, Solana | Ethereum, others | Ethereum, Tron, others | Ethereum, BSC, others |

How to get USDCV

Because of the EMI licensing, SG‑FORGE only permits qualified institutional participants and certain regulated brokers to hold USDCV. Retail investors in the United States cannot directly buy the token, a limitation driven by both MiCA compliance and existing US securities law.

If you are an eligible entity, you can access USDCV through:

- Direct custodial accounts with BNY.

- Supported crypto exchanges that have listed USDCV (e.g., Kraken, Bitstamp - note that listings are still limited).

- Qualified market makers that provide over‑the‑counter (OTC) desks for large‑scale purchases.

Once you have USDCV in a wallet that supports either ERC‑20 or SPL standards, you can move it instantly across the two chains, use it in DeFi protocols, or settle fiat‑linked invoices.

Risks and things to watch

Even institutional stablecoins carry risk. Here are the main points to consider:

- Regulatory change: MiCA is still evolving. Future EU rules could adjust reserve requirements or reporting obligations.

- Custody concentration: BNY holds all reserves. Any operational issue at the custodian could affect liquidity.

- Limited market depth: Low daily volume means price slippage can happen if you try to move large sums quickly.

- Geographic restriction: U.S. residents are barred from buying USDCV, which caps potential user growth.

For institutions, the upside often outweighs these concerns because the token offers a regulated, transparent bridge between traditional finance and blockchain.

Bottom line

If you need a dollar‑stable coin that carries the backing of a major European bank and complies with the newest EU crypto rules, USDCV is worth a look. Its dual‑chain approach gives you flexibility, and its EMT classification provides a level of legal certainty that most DeFi tokens lack. Expect modest trading volumes for now, but keep an eye on institutional adoption - especially as more companies experiment with on‑chain settlement.

Frequently Asked Questions

Is USDCV the same as USDC?

No. USDCV is issued by Société Générale‑Forge and follows the MiCA EMT framework, while USDC is a US‑regulated stablecoin issued by Circle. Both aim for a $1 peg but differ in custodians, regulatory regimes, and supported chains.

Can I buy USDCV on a regular crypto exchange?

Only a few regulated exchanges list USDCV, and they typically require KYC for institutional clients. Retail users, especially in the United States, are not allowed to purchase it directly.

How is the dollar reserve verified?

Bank of New York Mellon publishes daily audited reports detailing the amount and quality of the USD assets backing USDCV. SG‑FORGE calls this “total transparency”.

What are the main advantages of using Solana for USDCV?

Solana’s sub‑second finality and very low fees make high‑frequency transfers cheap, which is useful for settlement and arbitrage activities that need speed and cost efficiency.

Will USDCV ever be available to U.S. investors?

Société Générale‑Forge would need to obtain U.S. regulatory approval, which could involve registering as a Money Services Business or securing a charter. No public timeline exists yet.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

13 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Oh wow, another ‘EU-approved’ stablecoin? 🤡 Let me guess - BNY Mellon is just a front for French bankers trying to outdo the US. Meanwhile, USDC and USDT are moving billions daily while this thing struggles to hit $30M in volume. MiCA? Cute. Real institutions aren’t waiting for paperwork to move money.

USDCV is useless if you’re in the US.

While the regulatory framework under MiCA represents a significant advancement in institutional crypto compliance, the limited liquidity and geographic restrictions severely constrain its utility as a scalable financial instrument. One must question whether the operational overhead of custodial dependency on BNY Mellon justifies the marginal gains in transparency over existing alternatives.

Brooo this is actually 🔥! Finally, someone built a stablecoin that doesn’t feel like a meme. USDCV on Solana for low fees + Ethereum for DeFi? Genius combo. And BNY Mellon backing it? That’s like having Warren Buffett as your accountant. I’ve been waiting for this since 2021. Let’s goooooo! 🚀💰

So… you need to be an institution to buy this? Cool. So it’s just a fancy bank experiment. I’ll stick with USDT, thanks. Also, why is Solana even in this? 😴

wait u mean USDCV is on solana too?? that’s wild!! i thought only eth… but yeah solana is way faster and cheeper for trades. but why no us people?? dumb. i tried to buy it on kraken but it said ‘not available in your region’ 😭

For institutional users, this is a quiet revolution. No more juggling between fiat wires and crypto. USDCV gives you the stability of USD, the speed of blockchain, and the legal cover of MiCA. It’s not for retail, and it doesn’t need to be. The real game is in treasury management and cross-border settlement - and this nails it. Keep an eye on corporate adoption over the next 12 months.

Of course France had to make their own dollar. Can’t let America have all the fun, right? But let’s be real - if this was American, it’d be on every exchange. Instead, it’s stuck behind EU bureaucracy and a single custodian. Classic. The US dollar doesn’t need a European middleman.

It’s interesting how we keep trying to make crypto feel like banking… but maybe that’s the point. USDCV isn’t trying to disrupt - it’s trying to integrate. That’s why it’s slow. That’s why it’s boring. And honestly? That’s what the market needs right now. Not another meme coin. Just a clean, quiet, regulated dollar on-chain.

Wow! 🌍✨ Finally, a crypto project that respects both tradition and innovation! The elegance of MiCA compliance + dual-chain architecture is a masterpiece of modern finance. As an Indian observer, I’m proud to see global institutions finally moving beyond US-centric models. Kudos to SG-FORGE! 🙌🇮🇳🇪🇺

So you can’t buy it unless you’re rich and have a lawyer? Cool. 😒 And you call this ‘transparency’? BNY Mellon audits daily… sure, and my cat audits my fridge. Still, at least it’s not on Tron. 🤷♀️

This is exactly what Africa needs - regulated, dollar-backed digital liquidity that doesn’t require a US bank account. Why can’t Nigerian fintechs access this? The exclusion isn’t just geographic - it’s economic colonialism. If this is truly for global finance, then open the doors. Not just for hedge funds in London.

wait so if i'm in india can i buy this? or is it just eu + us institutions? i'm confused... also why solana? isn't it kinda unstable? i heard they had a big outage last year... 🤔