Crypto Adoption: How Markets, Policies, and Tools Shape the Future

When working with crypto adoption, the process of bringing digital currencies into everyday financial life. Also known as digital asset adoption, it connects users, businesses, and regulators to the blockchain ecosystem.

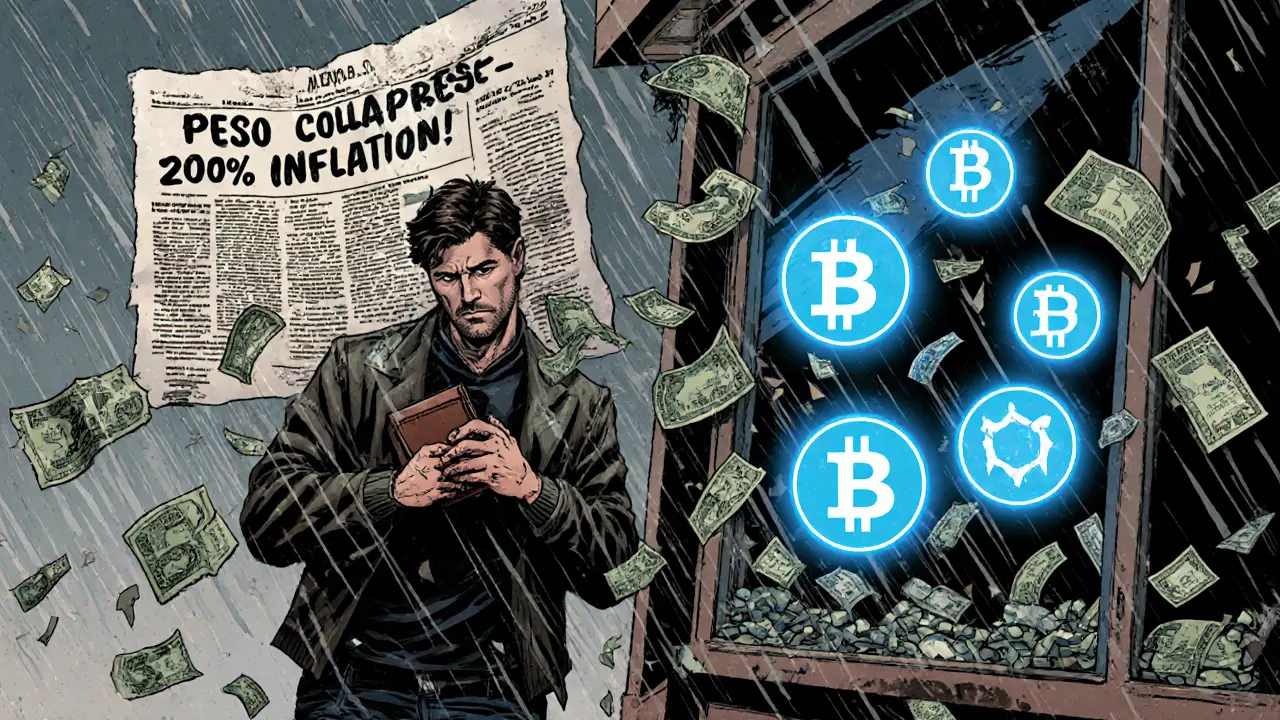

One of the biggest drivers of crypto adoption is regulation, the set of rules that define how crypto activities are monitored and enforced. Clear regulatory frameworks give investors confidence, enable banks to offer crypto services, and let governments tax digital transactions. At the same time, stablecoins, crypto tokens pegged to fiat currencies or assets act as a bridge between traditional money and the blockchain, making daily payments and cross‑border transfers smoother. When you pair stablecoins with trustworthy exchanges, the whole system feels safer for newcomers.

Another practical hook for people new to the space is the airdrop, a free distribution of tokens meant to spark interest and increase network participation. A well‑executed airdrop can turn a curious onlooker into an active user, especially when the token has clear utility. But free tokens also attract scammers, so exchange security, the combination of technical safeguards, insurance, and compliance checks used by trading platforms becomes essential. Strong security measures—cold storage, biometric 2FA, and insurance coverage—reduce the risk of hacks and help both seasoned traders and first‑time buyers feel protected.

Regulation influences crypto adoption by setting the rules companies must follow, while stablecoins influence adoption by offering a familiar value reference. Airdrops influence adoption by lowering the entry barrier, and exchange security influences adoption by building trust. Those four elements interact in a loop: better regulation encourages exchanges to invest in security, which makes airdrops safer, which in turn boosts stablecoin usage, and the cycle repeats.

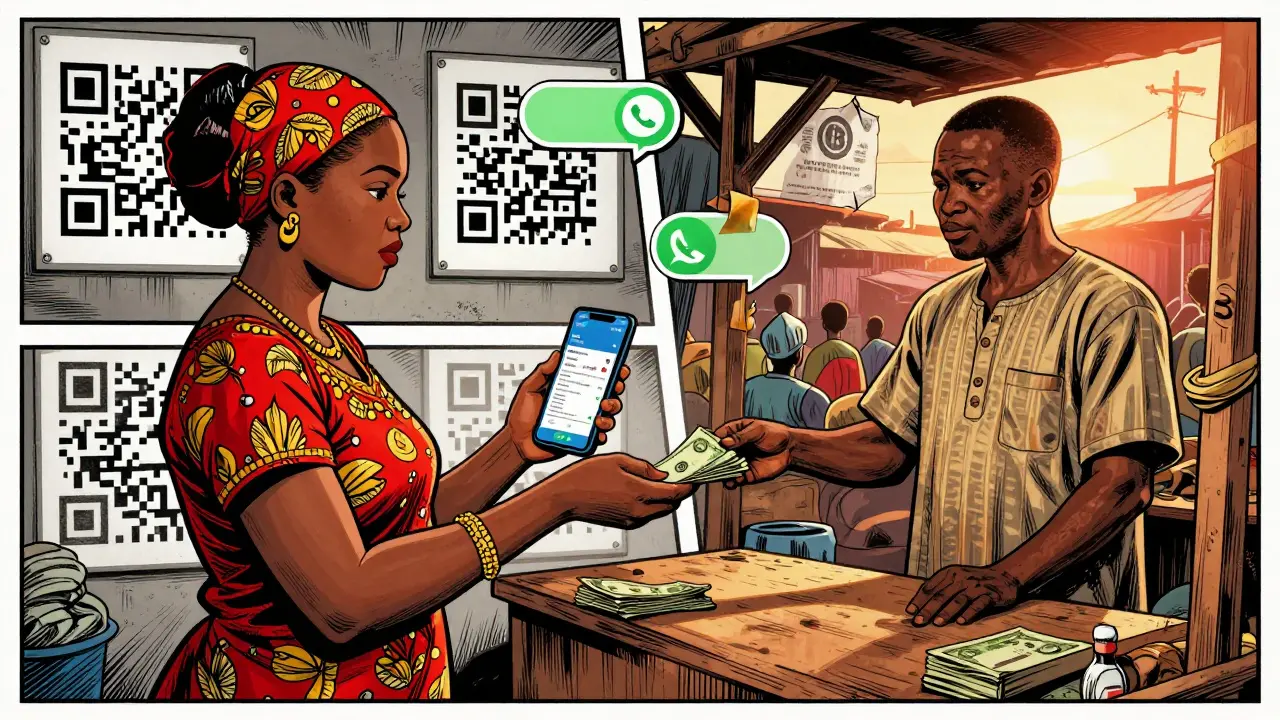

Across the globe, we see these dynamics at work. The UK’s two‑phase crypto framework aims to attract businesses while protecting consumers, and its FCA rules on advertising shape how projects market airdrops. In the UAE, free‑zone licensing lets crypto firms operate under clear guidelines, encouraging stablecoin projects to set up shop. Meanwhile, countries like Nigeria rely heavily on peer‑to‑peer platforms to bypass banking restrictions, showing how a lack of regulation can both hinder and accelerate adoption depending on the context.For anyone looking to understand where crypto adoption is heading, the key is to watch how these pieces fit together. Expect more governments to publish crypto‑friendly policies, expect stablecoins to become the default payment method for many online services, and expect exchanges to double down on security as the value locked in DeFi grows. Below you’ll find a curated collection of guides, analyses, and how‑to articles that dive deeper into each of these topics, from airdrop claim steps to exchange security best practices and regulatory overviews. Use them to shape your own strategy and stay ahead of the curve.