2025/10 Crypto Archive: DAO Voting, Airdrops, and Global Crypto Trends

When you look at the crypto landscape in October 2025, a month defined by governance experiments, regulatory shifts, and real-world crypto adoption. Also known as crypto’s maturity phase, this period showed how blockchain is moving beyond speculation into practical use cases—where decisions are made fairly, funds are protected, and nations adapt to digital money. The big theme? Power shifting. Not just from banks to wallets, but from whales to everyday holders, from central banks to decentralized systems.

Take DAO governance, a system where token holders vote on protocol changes without central control. Also known as on-chain democracy, it’s no longer theoretical—projects are using quadratic voting, a method that makes large token holders pay exponentially more for extra votes. This stops rich wallets from dominating decisions and gives small investors real influence. Meanwhile, blockchain scaling, the challenge of making networks faster and cheaper. Also known as Layer 2 solutions, tools like state channels, off-chain transaction pipelines that keep interactions secure but instant. These aren’t just tech demos—they’re powering real apps in gaming, micropayments, and supply chains.

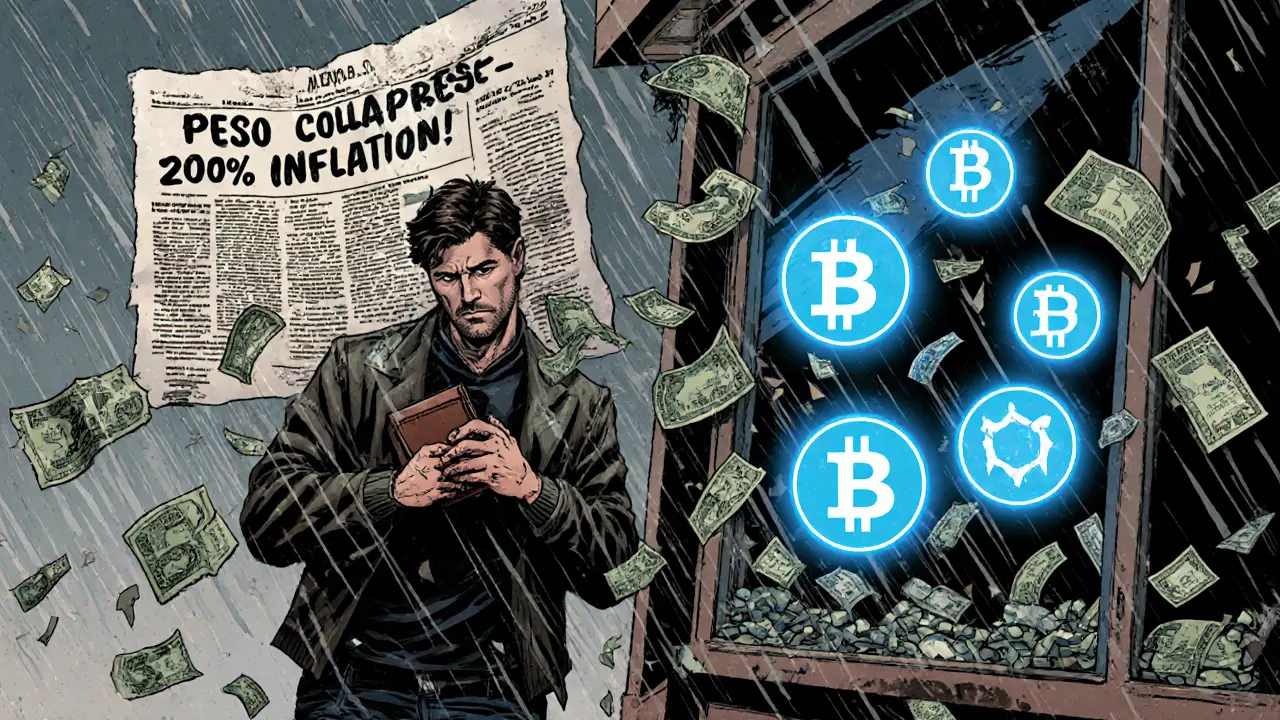

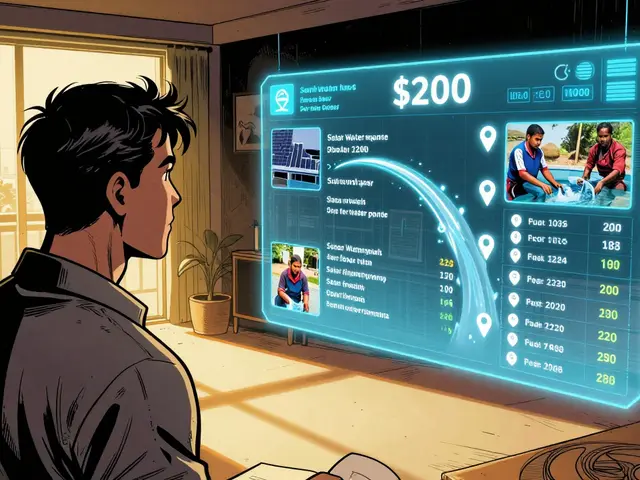

On the ground, countries are making bold moves. Stablecoin adoption, using digital dollars pegged to real currencies to dodge inflation and capital controls. Also known as digital cash for the unbanked, it’s exploding in Argentina and Nigeria, where people trade crypto on peer-to-peer platforms to buy food, pay rent, and send money abroad. Russia legalized mining to bypass sanctions, while Iran tries to use crypto for international trade—both facing energy, security, and legal hurdles. At the same time, the UK tightened its rules on crypto ads and pushed for a clear regulatory framework, showing how governments are trying to control what they can’t stop.

Airdrops kept people busy—but not all were real. Some were scams pretending to be from Unbound, Orica, or Showcase. Others, like ETHPAD and Genshiro, were legitimate distributions tied to real DeFi projects. Knowing the difference meant checking official channels, avoiding fake websites, and understanding token utility. Security stayed critical too—cold storage, biometric 2FA, and multi-party computation became standard advice, not optional extras. And with staking rewards now clearly taxed in 2025, investors had to track every reward like income, not just hope for gains.

What you’ll find below isn’t just a list of posts. It’s a snapshot of crypto’s turning point: where tech solves real problems, where regulation catches up, and where everyday users are finally gaining control. Whether you’re checking if a token is a scam, learning how to vote in a DAO, or figuring out how to protect your funds, these articles give you what you need—no fluff, no hype, just clear facts.